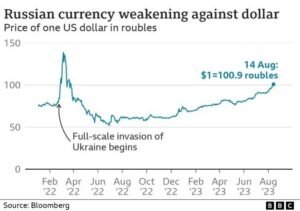

Russian rouble falls to 16-month low against US dollar

The value of the Russian rouble has reached its lowest point in 16 months and surpassed 100 against the US dollar.The drop occurs as pressure on the Russian economy mounts as military spending for the Ukraine war increases and imports grow faster than exports. Western nations have imposed sanctions on Russia as a result of its invasion of Ukraine in February 2022. After the war initially started, the rouble fell, but was later supported by capital controls and oil and gas exports.

Although its value has varied over the war, it has generally lost roughly 25% of its value versus the dollar since the invasion of Ukraine. The rouble was trading at 101.04 to the dollar earlier on Monday. Since the US dollar is often regarded as the most powerful currency in the world, the more roubles it takes to buy one dollar indicates that the currency is weakening.

Despite stating that it sees no threat to the nation’s financial stability, the central bank of Russia has indicated that a crucial interest rate increase is possible. The bank increased rates from 9.5% to 20% when Russia invaded Ukraine, but soon started lowering them. The current rate is 8.5%, and the Russian central bank will debate potential interest rate increases at an unusual meeting on Tuesday. No need to panic, but the decline of the rouble will be harmful to Russians The rouble has been “weakening gradually” this year, according to Jane Foley, managing director at Rabobank London, who also noted that “the pace has picked up since late July.”

She continued, “The rouble’s weakness reflects a weakening fundamental backdrop in Russia,” noting that the nation’s budget was in deficit and that it was dependent on imports from Turkey and China but was under pressure to increase exports. Russ Mould, investment director at AJ Bell, claimed that Western sanctions were hurting Russia’s trade and therefore its economy, “especially for oil and gas.” Since the start of the war, many EU nations that relied on Russian oil and gas have vowed to gradually reduce their imports and find substitute supplies.

G7 and EU leaders unveiled a price cap plan in December 2022 with the intention of reducing the amount of money Russia can make from oil exports by attempting to maintain the price below $60 per barrel. This has contributed to the decline in the value of Russia’s oil exports. Additionally, Russia shut off the gas supply to Europe, raising concerns about blackouts. Germany, a former major importer, declared in January that it no longer relied on the country’s fossil resources for its energy needs.

Inflows of hard currency are decreasing due to decreased exports, while imports are increasing and even dependable trading partners like China seem unwilling to accept roubles, according to Mr. Mould.

Moscow had also been impacted by Russia’s absence from Swift, a global payment system used by thousands of financial firms. However, Mr. Mould said that the “weakness of the rouble must also be set against the strength of the dollar,” with the dollar “gaining ground against emerging currencies across the board.” He claimed that part of the reason for this was the robust US economy, which “is forcing the Federal Reserve to raise interest rates in contrast to many emerging central banks, which are starting to cut (particularly Brazil and Chile),” according to him. “Higher returns on cash in dollars and lower ones in other currencies can increase the relative attractiveness of holding greenbacks, or assets denominated in them,” Mr. Mould continued.

Read more articles at:

Want the Keys to the Castle? Demystifying Real Estate Investment